One of my favorite papers is a Health Affairs piece by Bruce Vladeck, the former administrator of what was then HCFA, (the Health Care Financing Administration, now CMS - the Centers for Medicare and Medicaid Services) entitled, The Political Economy of Medicare: Medicare Reform Requires Political Reform. In it he contrasts the view of Medicare beneficiaries as "Greedy Geezers" who just want to spend, spend, spend other people's money on health care versus the observation that Medicare's money is most directly spent on "providers" for whom it is a source of income. Drawing an analogy to President Eisenhower's famous warning, he dubs this constituency "the health-care industrial complex."

Recently there has been a great deal of attention to "entitlement" programs (itself a loaded term) such as Social Security, Medicare, and Medicaid. Clearly, there is an upswing in characterizing older adults as "Greedy Geezers" particularly "entitled" about health care spending. But what Dr. Vladeck reminds us is that Medicare puts no money in the hands of older people. At the very most, it buys them health care -- services and products -- by paying other people. And despite what doctors often feel about the endless neediness of their patients, in my experience, most people would prefer to avoid health care entirely and don't actually enjoy the process itself.

Knowing this, I was very struck by an op-ed in the Wall Street Journal from the middle of July:

I have never seen an analysis that shows a 50% increase in health service utilization attributable to having Medicare (as opposed to insurance from an employer) after controlling for age and health status. It really struck me because Medicare (at least without supplementation) is not very good insurance compared to mine or that of most people who have commercial insurance purchased for them by a large employer. So, I would be very interested in how to interpret such a result (greedy geezers vs. health care industrial complex?). However, I would like to get the facts straight before trying to explain them.

Now, I am not an actuary or even an economist and there are some very technical arguments about the role of moral hazard in insurance (that is people doing things once insured that they wouldn't do with their own money). And some suspect moral hazard particularly if a beneficiary has "first dollar coverage," as is possible if he or she has purchased one of the more generous (and expensive) Medicare Supplemental Plans (Medigap). I know these issues are complex and contentious, but I would really like to know if this phenomenon is real.

I started by writing to the authors about the source of their data. They were very polite and quick to reply, and in addition to offering to talk me through their analyses on the phone, they told me to look at a 1990s study somewhere on the website of the Council for Affordable Health Insurance (still can't find it) or to stay tuned for a book to come out next year.

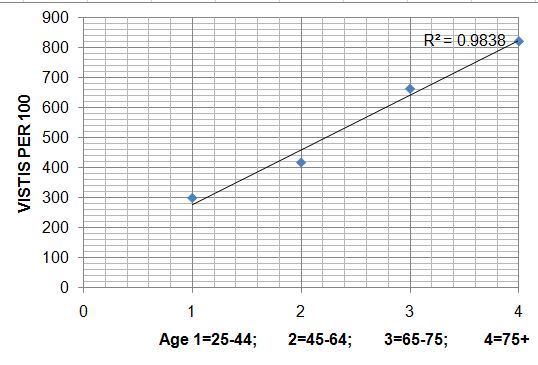

I must say that I don't really think it is fair to say that we have been "ignoring one key factor" when it really hasn't been made very public. So in the meantime I went to the public data available at the National Center for Health Statistics and looked up age and ambulatory care visit rates. I figured that if moral hazard were at work, it would show itself the most in ambulatory visits (as opposed to hospitalizations or nursing home stays that seem less voluntary). And this is what I found for all site ambulatory care visits (primary care, specialty, ED). Please pardon my bad excel graphing:

Even without adjustment for health status, the relationship looks like a straight line to me and doesn't seem to increase faster after age 65 when insurance usually changes. Moreover, these data are going to be a very conservative view, as they reflect the entire population -- including those who had no coverage when they were younger than 65 (and therefore fewer visits).

Perhaps I'm missing something or doing something wrong, but I just don't see an increase in utilization that can't be attributed to age. Perhaps the age ranges are wrong to see an inflection towards higher than predicted use for Medicare beneficiaries or perhaps I've misunderstood the point. But until it is clearer, I don't see any phenomenon to discuss except that as people age they have more health problems, need more care, and have more visits. If anyone has data on the WSJ argument or knows where to get it, I would be very grateful.